House Rent Exemption Under Income Tax . in case you own any residential property at any place for which your income from house property is calculated under applicable sections (as a. if you rent a furnished or unfurnished place and do not receive house rent allowance as part of your salary, you can claim a deduction for the. our hra exemption calculator will help you calculate what portion of the hra you receive from your employer is exempt from tax and how much is. section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance (hra) to claim deductions for. inr 1,90,000 will be exempt from the total house rent allowance received and the remaining inr 60,000. Hra is usually included in.

from rent-receipt-form.pdffiller.com

if you rent a furnished or unfurnished place and do not receive house rent allowance as part of your salary, you can claim a deduction for the. our hra exemption calculator will help you calculate what portion of the hra you receive from your employer is exempt from tax and how much is. section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance (hra) to claim deductions for. in case you own any residential property at any place for which your income from house property is calculated under applicable sections (as a. Hra is usually included in. inr 1,90,000 will be exempt from the total house rent allowance received and the remaining inr 60,000.

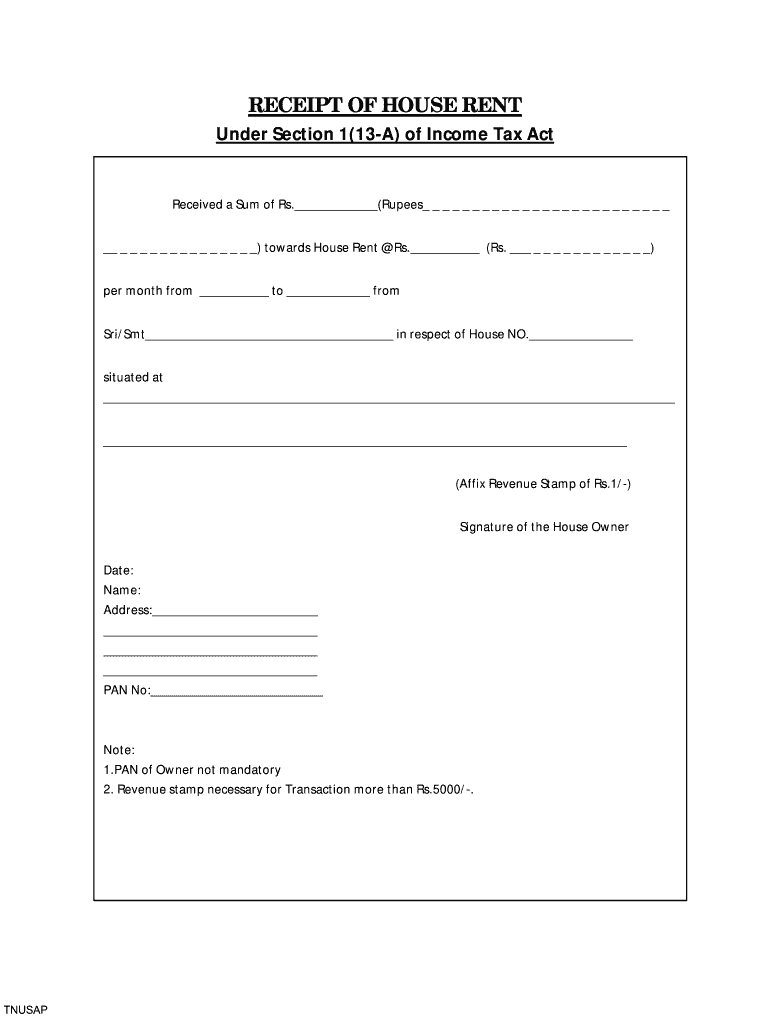

2012 Form India Receipt of House RentFill Online, Printable, Fillable

House Rent Exemption Under Income Tax section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance (hra) to claim deductions for. in case you own any residential property at any place for which your income from house property is calculated under applicable sections (as a. section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance (hra) to claim deductions for. inr 1,90,000 will be exempt from the total house rent allowance received and the remaining inr 60,000. if you rent a furnished or unfurnished place and do not receive house rent allowance as part of your salary, you can claim a deduction for the. Hra is usually included in. our hra exemption calculator will help you calculate what portion of the hra you receive from your employer is exempt from tax and how much is.

From 7thpaycommissionnews.in

HRA tax exemption Calculator House rent deduction in Tax House Rent Exemption Under Income Tax if you rent a furnished or unfurnished place and do not receive house rent allowance as part of your salary, you can claim a deduction for the. our hra exemption calculator will help you calculate what portion of the hra you receive from your employer is exempt from tax and how much is. Hra is usually included in.. House Rent Exemption Under Income Tax.

From in.pinterest.com

exempted Business tax deductions, tax return, House Rent Exemption Under Income Tax in case you own any residential property at any place for which your income from house property is calculated under applicable sections (as a. inr 1,90,000 will be exempt from the total house rent allowance received and the remaining inr 60,000. if you rent a furnished or unfurnished place and do not receive house rent allowance as. House Rent Exemption Under Income Tax.

From learn.quicko.com

Exempt under Tax Learn by Quicko House Rent Exemption Under Income Tax if you rent a furnished or unfurnished place and do not receive house rent allowance as part of your salary, you can claim a deduction for the. inr 1,90,000 will be exempt from the total house rent allowance received and the remaining inr 60,000. our hra exemption calculator will help you calculate what portion of the hra. House Rent Exemption Under Income Tax.

From www.youtube.com

Calculation of House Rent Allowance (HRA) Tax Exemption under House Rent Exemption Under Income Tax section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance (hra) to claim deductions for. if you rent a furnished or unfurnished place and do not receive house rent allowance as part of your salary, you can claim a deduction for the. in case you own any. House Rent Exemption Under Income Tax.

From mavink.com

Sample House Rent Receipt For Tax House Rent Exemption Under Income Tax if you rent a furnished or unfurnished place and do not receive house rent allowance as part of your salary, you can claim a deduction for the. in case you own any residential property at any place for which your income from house property is calculated under applicable sections (as a. inr 1,90,000 will be exempt from. House Rent Exemption Under Income Tax.

From rent-receipt-form.pdffiller.com

2012 Form India Receipt of House RentFill Online, Printable, Fillable House Rent Exemption Under Income Tax inr 1,90,000 will be exempt from the total house rent allowance received and the remaining inr 60,000. section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance (hra) to claim deductions for. our hra exemption calculator will help you calculate what portion of the hra you receive. House Rent Exemption Under Income Tax.

From www.taxscan.in

Exemption u/s. 11 of the Act is allowable When TaxReturn filed House Rent Exemption Under Income Tax section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance (hra) to claim deductions for. Hra is usually included in. in case you own any residential property at any place for which your income from house property is calculated under applicable sections (as a. inr 1,90,000 will. House Rent Exemption Under Income Tax.

From studycafe.in

HRA Exemption House Rent Exemption U/S 10(13A) House Rent Exemption Under Income Tax Hra is usually included in. inr 1,90,000 will be exempt from the total house rent allowance received and the remaining inr 60,000. section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance (hra) to claim deductions for. our hra exemption calculator will help you calculate what portion. House Rent Exemption Under Income Tax.

From timesofindia.indiatimes.com

Budget 2023 Tax Slabs Savings Explained New tax regime vs Old House Rent Exemption Under Income Tax our hra exemption calculator will help you calculate what portion of the hra you receive from your employer is exempt from tax and how much is. in case you own any residential property at any place for which your income from house property is calculated under applicable sections (as a. if you rent a furnished or unfurnished. House Rent Exemption Under Income Tax.

From vakilsearch.com

HRA Tax Exemption How to save tax on House Rent Allowance House Rent Exemption Under Income Tax inr 1,90,000 will be exempt from the total house rent allowance received and the remaining inr 60,000. Hra is usually included in. in case you own any residential property at any place for which your income from house property is calculated under applicable sections (as a. section 80gg of the income tax act in india allows individuals. House Rent Exemption Under Income Tax.

From exowyvjkx.blob.core.windows.net

House Rent In Tax Saving at Charles Workman blog House Rent Exemption Under Income Tax Hra is usually included in. section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance (hra) to claim deductions for. if you rent a furnished or unfurnished place and do not receive house rent allowance as part of your salary, you can claim a deduction for the. . House Rent Exemption Under Income Tax.

From fincalc-blog.in

HRA Exemption Calculator in Excel House Rent Allowance Calculation House Rent Exemption Under Income Tax inr 1,90,000 will be exempt from the total house rent allowance received and the remaining inr 60,000. if you rent a furnished or unfurnished place and do not receive house rent allowance as part of your salary, you can claim a deduction for the. Hra is usually included in. section 80gg of the income tax act in. House Rent Exemption Under Income Tax.

From www.exemptform.com

FREE 10 Sample Tax Exemption Forms In PDF House Rent Exemption Under Income Tax in case you own any residential property at any place for which your income from house property is calculated under applicable sections (as a. inr 1,90,000 will be exempt from the total house rent allowance received and the remaining inr 60,000. our hra exemption calculator will help you calculate what portion of the hra you receive from. House Rent Exemption Under Income Tax.

From www.signnow.com

Sample Letter Tax Exemption Complete with ease airSlate SignNow House Rent Exemption Under Income Tax if you rent a furnished or unfurnished place and do not receive house rent allowance as part of your salary, you can claim a deduction for the. Hra is usually included in. our hra exemption calculator will help you calculate what portion of the hra you receive from your employer is exempt from tax and how much is.. House Rent Exemption Under Income Tax.

From carajput.com

How to claim HRA allowance, House Rent Allowance exemption House Rent Exemption Under Income Tax inr 1,90,000 will be exempt from the total house rent allowance received and the remaining inr 60,000. if you rent a furnished or unfurnished place and do not receive house rent allowance as part of your salary, you can claim a deduction for the. Hra is usually included in. section 80gg of the income tax act in. House Rent Exemption Under Income Tax.

From livaygwyneth.pages.dev

Nc State Tax Standard Deduction 2024 Aubrey Caprice House Rent Exemption Under Income Tax our hra exemption calculator will help you calculate what portion of the hra you receive from your employer is exempt from tax and how much is. if you rent a furnished or unfurnished place and do not receive house rent allowance as part of your salary, you can claim a deduction for the. in case you own. House Rent Exemption Under Income Tax.

From www.vrogue.co

How To Write A Waiver Letter For Tax Exemption Printable Form Vrogue House Rent Exemption Under Income Tax if you rent a furnished or unfurnished place and do not receive house rent allowance as part of your salary, you can claim a deduction for the. Hra is usually included in. section 80gg of the income tax act in india allows individuals who pay rent but don't receive house rent allowance (hra) to claim deductions for. . House Rent Exemption Under Income Tax.

From gioguazha.blob.core.windows.net

Food Coupons Exemption Under Tax Section at Timothy Hale blog House Rent Exemption Under Income Tax if you rent a furnished or unfurnished place and do not receive house rent allowance as part of your salary, you can claim a deduction for the. inr 1,90,000 will be exempt from the total house rent allowance received and the remaining inr 60,000. in case you own any residential property at any place for which your. House Rent Exemption Under Income Tax.